Check Vehicle Insurance Status

Car sales have increased manifold in India in the last few years. Many reasons can be attributed to the jump in car sales. The primary reason is that cars are no longer considered luxury items. Many, in fact, have more than one car as their disposable income has gone up over the years. In tune with the rise in car sales, there is a higher demand for car insurance policies too.

It is mandatory in India to buy third–party liability insurance if you own a car. You need to have separate third–party liability insurance policies for every car you own. In other words, with each car purchase, there is a mandatory purchase of a car insurance policy.

A car insurance cover is an important document. If you misplace it, you could land in deep trouble. But fret not. If you are unable to find your insurance policy, you can check your vehicle insurance history, and there are different channels to do that.

You may need to check your car’s insurance status if you have lost your insurance policy details. Another situation wherein you may need to check the status is when you meet with an accident, and you need to track down the details of the car in question.

Before we learn how to check car insurance status, it is important to know the different types of car insurance policies available.

Types of insurance policiesCar insurance is mandatory by law, so car owners usually end up buying third–party liability insurance rather than a comprehensive plan. While third–party liability insurance costs less, they cover limited expenses. Along with third–party liabilities, here are other insurance policies to know.

Third–party liability insurance: This is a mandatory cover that all vehicle owners in the country should have. It covers you in case of third–party liabilities that may arise if your vehicle was involved in an accident. Simply put, if Rahul crashes his car into Riya’s car, Rahul’s insurance provider only pays for damages caused to Riya’s car. That means Rahul still has to bear expenses to repair damages to his car. You also get no riders, and the insurance policy’s premium is determined by the regulator–the Insurance Regulatory and Development Authority of India (IRDAI).

Comprehensive insurance: A comprehensive insurance cover will cover damages to your vehicle and third–party liabilities. The extensive coverage protects you in case of an accident caused due to natural or man–made calamities or theft. The insurance cover also comes with optional riders that can help increase areas of protection. Comprehensive insurance premiums tend to be higher as compared to third–party liability insurance. It is advisable to invest in comprehensive insurance so that you get complete protection at all times.

Own damage policy: This policy will only provide for the damages to your vehicle. An own damage policy does not cover third–party liability. You may purchase an own damage insurance plan over and above the third–party liability insurance. However, it may fail to provide adequate coverage in case of accidents.

How to check the status of your car insurance?When you purchase an insurance policy, it gets linked to your vehicle’s registration number. Therefore, you are required to buy a separate policy for every vehicle you own. Linking insurance with the registration number helps you check your vehicle insurance status online by using the registration details. To find out how to check car insurance, here are some easy ways.

A. How to Check Car Insurance Policy Status Online

You can check your vehicle insurance status online via

- IIB

- VAHAN E–services

- QR Code

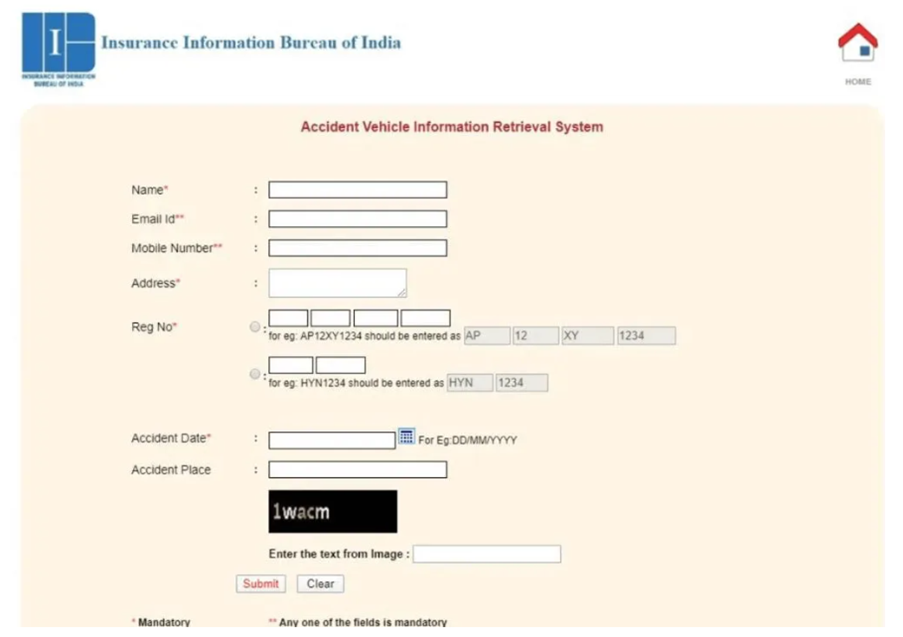

The Insurance Regulatory and Development Authority has a website known as Insurance Information Bureau or IIB. You can find all the details about the insurance policies that have been issued in India on this portal. Here are the steps to follow.

Step 1:Visit the IIB website

Step 2:On the tab “Quick Links”, you need to click on V–Seva.

Step 3:You will be redirected to the page of the retrieval system for accident vehicle information.

Step 4:

Step 4:

Provide the details like the owner’s name, mobile number, address, vehicle registration number and email ID.

Step 5:Additionally, if the vehicle has been damaged in an accident and you require further details to file a claim, you must provide information like the place and date of the accident.

Step 6:Submit the form, and you will see the status of the insurance policy.

Things to keep in mind on the IIB portal:

- When you check the insurance status, it is important to enter the registration number, excluding the special characters.

- After purchasing the policy, you will see the details on the portal after two months. So, if you are trying to check the status of the vehicle within two months, you will not be able to find anything on the website.

- Whenever submitting the details of a new vehicle on the portal, insurance companies only submit the engine and chassis number.

- You can only see the information of the vehicle that has been bought after April 2010.

- It is possible to conduct only three searches on one mobile number or email ID.

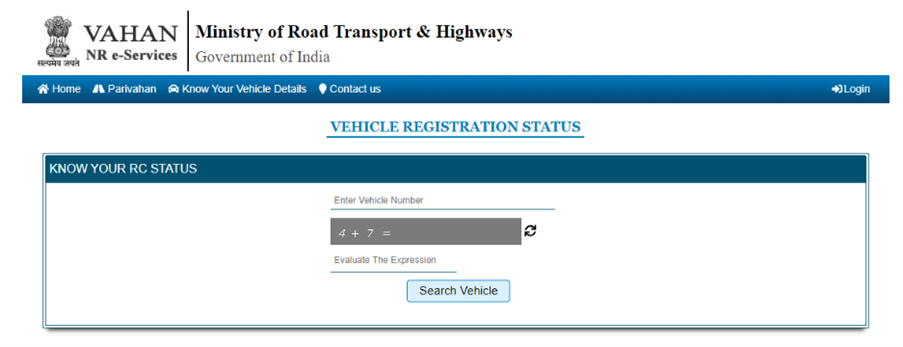

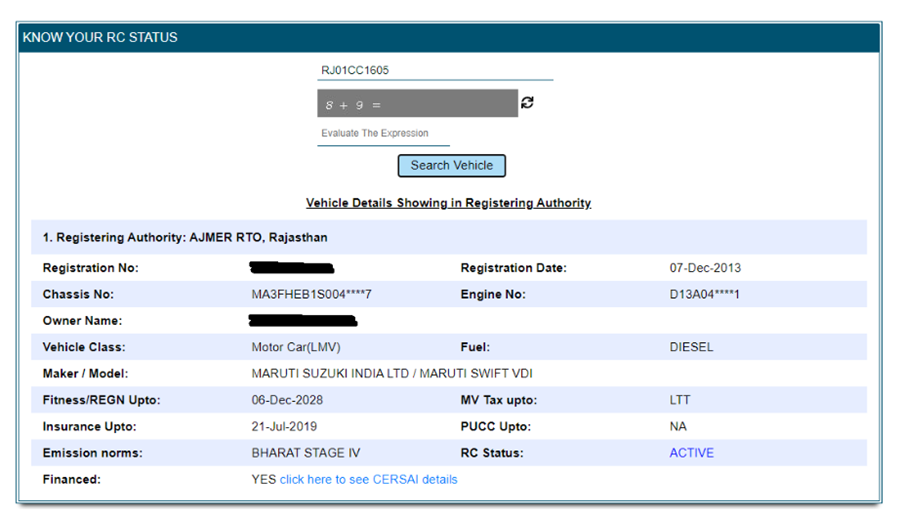

You can also check your car insurance status on VAHAN, a Ministry of Road Transport and Highways website.

Step 1:Visit the VAHAN e–Services website and click on “Know Your Vehicle Details”.

Step 2:

Step 2:

Create your account by verifying your mobile number and email ID.

Step 3:Now, provide the registration number of the car, and enter the verification code.

Step 3:Click on ‘‘Search Vehicle’’.

Step 4:You will see your car insurance details here.

3) Check Car Insurance Policy Details Via QR Code

3) Check Car Insurance Policy Details Via QR Code

The IRDAI has mandated insurance companies to add a Quick Response (QR) code for every insurance policy. When you need to check your insurance details, you can simply scan the QR code on your smartphone and get your car insurance details.

B. How to Check Car Insurance Policy Status OfflineIf you cannot find the insurance details through online means, you can use offline methods. You can visit the Regional Transport Office with the details of the vehicle. You may also speak to the insurance company and check the status.

Frequently Asked Questions Can I drive a vehicle without motor insurance?As per the Motor Vehicle Act, 1988, you would be breaking the law if you drive a vehicle without insurance, and the penalty would be a fine or imprisonment.

Why can I not see my car insurance details on the IIB portal?After you have purchased the policy, it takes up to two months for the insurance details to reflect on the IIB Portal.

What are the advantages of checking my vehicle insurance status online?If your car has been damaged during an accident, you may need to access your insurance details. In such cases, you can easily check your car insurance status online via multiple channels using your vehicle registration number. If you are buying a used car from a dealership or owner, you can check the car's authenticity by checking its number plate.

ConclusionIt is important to be aware of the insurance status of your vehicle. If you miss out on renewing the policy on time, it will lapse, and you will end up without insurance cover. Those who have misplaced the insurance policy or are not aware of the coverage can use one of the online or offline methods to check vehicle insurance history. You must have the details about your vehicle handy in order to deal with unwanted situations like accidents or theft.

Recent Blogs

Motor Insurance

Benefits of Car Insurance

Owning a car is a matter of pride. A four-wheeler is an asset that needs to be protected. Hence, the need for car insurance arises. A car insurance policy is essentially a contract signed between you and the insurance company. Under this contract, the insurer offers you cover against any financial loss arising due to damage or theft of your insured vehicle. In exchange, you have to pay a small amount of money as premium at fixed intervals of time (usually every year). If you are still not convinced about buying a motor insurance policy, then take a look at some of the key benefits of car insurance to understand its need better:

Legal compliance:

Buying a car insurance policy is necessary as third-party cover is mandatory for all vehicles in India. According to the terms of the Motor Vehicles Act 1988, driving a car without third-party insurance is a punishable offence in the country and can lead to heavy penalties. Hence, buying car insurance ensures legal compliance, which is one of the biggest advantages of motor insurance.

Saves money:

A car insurance policy can cover most of the repair expenses on your vehicle and can reduce those big garage bills in the aftermath of a mishap, thereby helping you save a lot of money. This is the primary reason why insurance is bought and is, without question, the biggest benefit of a car insurance policy.

Third-party liabilities:

Third-party insurance protects you against any third-party liabilities in case of an accident involving your car. This means that if your car hits another vehicle on the road and damages it, your third-party liability cover will help you compensate the owner of the other vehicle to the extent of damages suffered by him/her.

Minimises liability arising due to loss of lives:

Not just property or car damage, third-party car insurance also pays for the other person's injury or death in case of an accident. It protects you from legal repercussions, which is one of the major advantages of car insurance.

Reimbursement in case of theft:

A stolen vehicle can burn a deep hole in your pocket as well in your heart. With Total Loss Car Insurance, if your car is termed as a total loss (after theft or an accident), then the insurance company pays you an amount equal to the current market value of your vehicle.

Cashless claims:

One of the key benefits of motor insurance is the cashless claims facility that offers you the benefit of getting your vehicles repaired without paying money at any of the network garages of the insurer. The reimbursement of expenses is directly handled between the insurance provider and its network garages. You just drop your vehicle there after the mishap, do the necessary paperwork and drive your car out when it is ready without paying any bills.

Roadside assistance:

A car insurance policy can come with add-on roadside assistance cover that can prove to be extremely useful while handling vehicle breakdowns in the middle of the road, especially at odd times. With a Roadside Assistance cover for your car, you can simply contact your insurer, inform it about the breakdown and your location. The rest will be handled by the insurer. It will send you timely help by coordinating with its network garages and mechanics. You just need to wait in your vehicle and not worry about managing the situation.

Disclaimer: The above information is indicative in nature. For more details on the risk factor, terms and conditions, please refer to the Sales Brochure and Policy Wordings carefully before concluding a sale.Motor Insurance

Types of Bike Insurance

A two–wheeler allows you to travel with a lot of freedom by facilitating easy traffic navigation and convenient parking. If you are a bike owner, you must opt for a correct bike insurance policy to protect your finances in case of any unforeseen circumstances. There are various types of bike insurance policies available in the market today. To help you choose, we’ll explain what each of these policy types can do for you. But first, let’s understand what bike insurance is.

What is Bike Insurance?

Navigating busy roads can expose your two–wheeler to risks and accidents. If an accident or collision occurs, it can cause severe injuries to people and damage your bike. A bike insurance plan covers you against the expenses you would otherwise face in paying for these damages and losses. As a policyholder, you are required to pay timely premiums in exchange for the insurance coverage offered.

What Are the Types of Bike Insurance?

The types of 2–wheeler insurance available are:

Third–party liability–only cover: According to the Motor Vehicles Act, 1988, a bike should mandatorily be insured for any liability that could arise due to loss or damage suffered by third parties in an accident caused by the insured bike. Thus, this type of bike insurance plan is popularly known as third–party bike insurance. Under this policy, if an accident is caused by the insured bike, then damage done to a third–party vehicle, or injuries and loss of life caused to a third–party, shall be reimbursed by the insurer.

Keep in mind that a third–party insurance policy does not cover own damages. In case of an accident, the damages to the insured vehicle would be borne by the owner under this policy. A personal accident cover is also a mandatory requirement for all motorists, and this has to be purchased with third–party insurance if the bike owner is already not covered under such a plan.

Standalone own damage cover: This is a type of two–wheeler insurance policy that covers damages caused to the insured bike. It covers the bike against natural calamities such as floods and earthquakes along with man–made calamities like theft. However, this policy does not cover third–party liabilities. You can buy a standalone own damage insurance policy along with the mandatory third–party insurance policy.

Comprehensive two–wheeler insurance: With a comprehensive two–wheeler insurance policy, you can avail a wider coverage. This type of policy is a combination of the own–damage cover for the insured bike and third–party insurance. You get covered against third–party claims and own damages in accidents, natural calamities, and manmade disasters. You can also opt to enhance your policy with add–on covers such as consumables cover, engine protection, and roadside assistance, among others.

For peace of mind on the road, buy bike insurance today. Before making the final decision, you must compare the coverage, policy options, and premium rates of bike insurance offered by different insurers. Also, check the credibility and reliability of the insurer beforehand. An insurance company with a proactive customer support team will help you avoid any inconvenience at a later stage.

Disclaimer: The above information is indicative in nature. For more details on the risk factor, terms and conditions, please refer to the Sales Brochure and Policy Wordings carefully before concluding a sale.

Motor Insurance

What Is Bike Insurance Claim Process?

India has one the highest number of two-wheelers in the world. Most two-wheeler owners are familiar with the idea of bike insurance as it is mandatory by law. Yet, surprisingly, the thought of filing a claim under the motor insurance policy sends jitters to many.

That’s because the bike insurance claim process is seen as a lengthy and complex procedure. Whereas, in reality, it is extremely straightforward and simple if you have all the relevant documents in place.

So, let us give you a detailed explanation of the two-wheeler insurance claim process to help you prepare for any such adverse situation that may arise in the future.

What is a Bike Insurance Claim?

A bike insurance claim is a formal demand made to the motor insurance company to compensate you for any expenses incurred due to damages to your vehicle arising out of theft or accident.

In fact, not just your vehicle, under a two-wheeler insurance procedure a claim can also be raised to demand compensation for property damage or personal injury related to a third party in case your bike caused a road mishap.

When it comes to the motor claim process, there are two types – cashless and reimbursement. The motor insurance claim process can be different for both types of claims. Let’s understand their meaning:

■ Cashless claim: In case your bike gets damaged after an accident and is taken for repair to an authorised garage, which is a part of the network of your insurance company, then you are eligible for cashless settlement of the claim. In a cashless settlement, your repair bill would be paid to the garage directly by your insurer without your involvement. It means you can just drive out of the garage without paying any penny if your claim is accepted and settled. ■ Reimbursement claim: If your bike is repaired at a garage that is not a part of the network of your insurance company, then you would have to settle all the bills yourself from your pocket. Later, you can ask your insurer for reimbursement of expenses by submitting the bills.Documents required to file a claim

You can make the vehicle insurance claim process completely hassle-free and smooth if you collate all the required documents and bills carefully and submit them along with your claim form. Here’s a list of the key documents required for a bike insurance claim procedure:

■ Duly filled and signed claim form ■ Copy of the registration certificate (RC) of the insured bike. ■ Copy of the driving license of the owner/driver of the bike. ■ Copy of the insurance policy document. ■ Copy of FIR, where needed (in case of theft or third-party bike damage). ■ Repair bills and receipts. ■ Other documents as demanded by the insurer (based on specific situations).Steps for two-wheeler insurance claim process

Here’s a step-by-step guide to help you understand the auto insurance claim process:

1. In case of a road accident, first, take note of the registration numbers of the other vehicles involved in the mishap. 2. Immediately intimate the insurance provider about the incident (theft or accident) and the upcoming claim. You can do this by calling on the customer care numbers of your insurance provider or by email or even at your insurer’s official website. 3. The insurance provider will ask for some basic details and provide you with a claim reference number for future correspondences. It will also guide you on the motor insurance claim procedure, document requirements and network garages. 4. You also need to visit the police station and file an FIR in case of theft or third-party claims. 5. Your insurer will then assign you an official inspector/surveyor who will examine the damage sustained by your bike. The surveyor may visit the location of the incident or your chosen garage. 6. Fill up and submit the claim form to your surveyor along with the required documents like driving license, RC book, police FIR, etc. 7. Based on the inspection of damages, the surveyor prepares a claim estimate and sends it to the insurer. 8. In the case of cashless settlements, the repair work starts at the network garage as soon as the insurer approves the claim estimate. After the repair is done, the insurer settles the final bill with the garage directly. 9. In case of reimbursements, you need to pay the garage yourself and then submit all the bills and receipts to the insurer later. 10. After due verification, the insurance company settles the claim usually within 30 days of receiving the last necessary document.Disclaimer: The above information is indicative in nature. For more details on the risk factor, terms and conditions, please refer to the Sales Brochure and Policy Wordings carefully before concluding a sale.

Motor Insurance

Bike insurance transfer to other person

One of the most common mistakes people make when they sell their bikes or two-wheelers is that they remember transferring ownership but forget to transfer the motor insurance policy to the buyer of the vehicle. Even those who remember are not aware of the process of how to transfer bike insurance from one person to another.

As a result, people sometimes just let the insurance policy be, thinking there will be no consequences. But that’s a myth. Not transferring the insurance policy to the new owner can lead to legal hassles for both the seller and the buyer and may also leave the bike without any insurance cover. Let’s see how.

What is bike insurance transfer?

Two-wheeler insurance transfer essentially refers to the process of transferring the insurance policy in the name of the new owner of the bike.

Once the two-wheeler insurance transfer is done, the bike insurance policy document should carry the name and details of the buyer of the vehicle and not that of the seller.

Under Section 157 of the Motor Vehicles Act, it is the responsibility of the buyer to apply to the insurance company requesting transfer of the bike insurance policy to his name. This application must be made within 14 days of buying the vehicle.

Remember that the two-wheeler insurance name transfer process can be initiated only after the bike ownership title has been transferred and the new RC book of the bike shows the name of the new owner.

If the new RC book is not yet available, the buyer can also submit the proof of transfer of ownership as a stop-gap arrangement. But he would have to compulsorily submit the new RC book to the insurer as soon as it is available.

Why should you transfer your bike insurance policy?

Transferring the bike insurance policy is very important both for the seller and buyer of the bike.

Suppose if the policy is not transferred, and the insured vehicle gets involved in a road accident, the insurance company would not clear even a single claim. That’s because the name on the policy document would not match the name of the new owner of the vehicle.

So, the buyer of the vehicle would have to bear all the expenses from his own pocket, whether it’s related to own damage or any third-party liability.

Not just the buyer, the seller can also land in trouble. In case of an accident, the court might get involved if both the insurer and/or the new owner of the bike refuses to pay any financial liabilities to the third party. Then, the court may also send notice to the seller to compensate for some of the losses incurred by the third party as the insurance policy still has his name on it.

Moreover, the seller also loses out on the no-claim bonus (NCB) earned on the bike insurance policy in case it is not transferred. NCB is a bonus you earn for not making any claim in the previous policy years.

For the seller, this bonus can translate into premium discounts on the insurance policy for his new bike. If the old policy is not transferred, the seller cannot avail the NCB certificate at all. Thus, the chances of getting discounts on any new insurance policy are lost.

Here’s how to transfer bike insurance from one person to another:

Now coming to the key part -- how to transfer two-wheeler insurance? Below is a step-by-step guide to help you through the process.

1. As soon as the transfer of ownership is done, the buyer needs to inform the insurance company about the same within the next 14 days and apply for bike insurance transfer. 2. As the new owner, you can also change to some other two-wheeler insurance plan by the insurer that suits your requirements better. 3. After you have chosen the new plan, fill up the proposal form giving details about the transfer of ownership of the bike. 4. The key documents that need to be submitted along with the proposal form include the new RC book of the bike or proof of transfer of ownership, original policy document, no-objection certificate from the previous policyholder, and address/identity proofs of the buyer along with some passport-sized photographs. 5. You should also submit Form 29/30/Sale deed along with the above-mentioned documents. Form 29 is the notice of transfer of ownership of a bike. This form notifies the Regional Transport Office (RTO) about the sale of the motorcycle. Whereas Form 30 is the report of transfer of ownership of the bike. It functions as the confirmation of Form 29. 6. After all the documents are submitted, the insurer will initiate the transfer process. In some cases, the insurance company might send an investigator to create an inspection report of the bike before the transfer is completed. 7. The buyer would need to pay a nominal transfer fee to transfer the policy in his name. 8. Once the fee is paid and everything is verified by the insurer, the policy would be transferred to the new owner of the bike.Disclaimer: The above information is indicative in nature. For more details on the risk factor, terms and conditions, please refer to the Sales Brochure and Policy Wordings carefully before concluding a sale.